All of our content is based on objective analysis, and the opinions are our own. Compound interest means that interest is computed on the principal of the note plus any interest that has accrued to date. For example, if you invest $10,000 at 12% interest for 3 years, your yearly interest income will be $1,200 ($10,000 x 0.12). The distinction between the two is important because it affects the amount of interest earned or incurred. So you would need to deposit $19,539.84 now to have $40,000 in 18 years. Simple interest and compound interest are important concepts to know about when it comes to someone’s personal finances.

Example: you have $1,000, and want it to grow to $2,000 in 5 Years, what interest rate do you need?

In other words, the borrower does not pay interest on the interest being charged. Meanwhile, compound interest refers to the interest charged on both the principal and the accrued interest of a loan. Simple interest and compound interest are key best procurement software for small and midsize businesses financial concepts when it comes to borrowing, saving and investing money. Simply put, simple interest and compound interest are two different ways of calculating the interest owed on a loan or the interest earned on savings or investments.

Solve the compound interest formula A = P(1 + i)n for P

The total interest earned over the 3 years would be $3,600, and you would eventually receive $13,600 ($10,000 + $3,600). Simple interest means that the interest payment is computed on only the amount of the principal for one or more periods. Bank \(B\)’s monthly compounding is not enough to catch up with Bank \(A\)’s better APR. Bank \(A\) offers a better rate. Continuing with the above example, suppose you can’t find a buyer but still believe in the company. You determine you need to borrow an additional $500,000 for three more years.

Example of calculating compound interest

In other words, daily compounding should yield more money than monthly compounding, for example. Simple interest means there is no “interest on interest.” With a loan, a borrower would not pay interest on accrued interest. With savings or investments, an account holder would not earn interest on accrued interest. As it relates to loans, simple interest refers to the amount of interest paid on the principal, or original amount borrowed.

Compounding is also why negative amortization loans like graduated-payment and reverse mortgages and some types of student loans can be financially crippling. Using the rule of 72, a $100,000 reverse mortgage at 4% becomes a $200,000 mortgage in 18 years. Bonds are a simple-interest loan from you to a government or company.

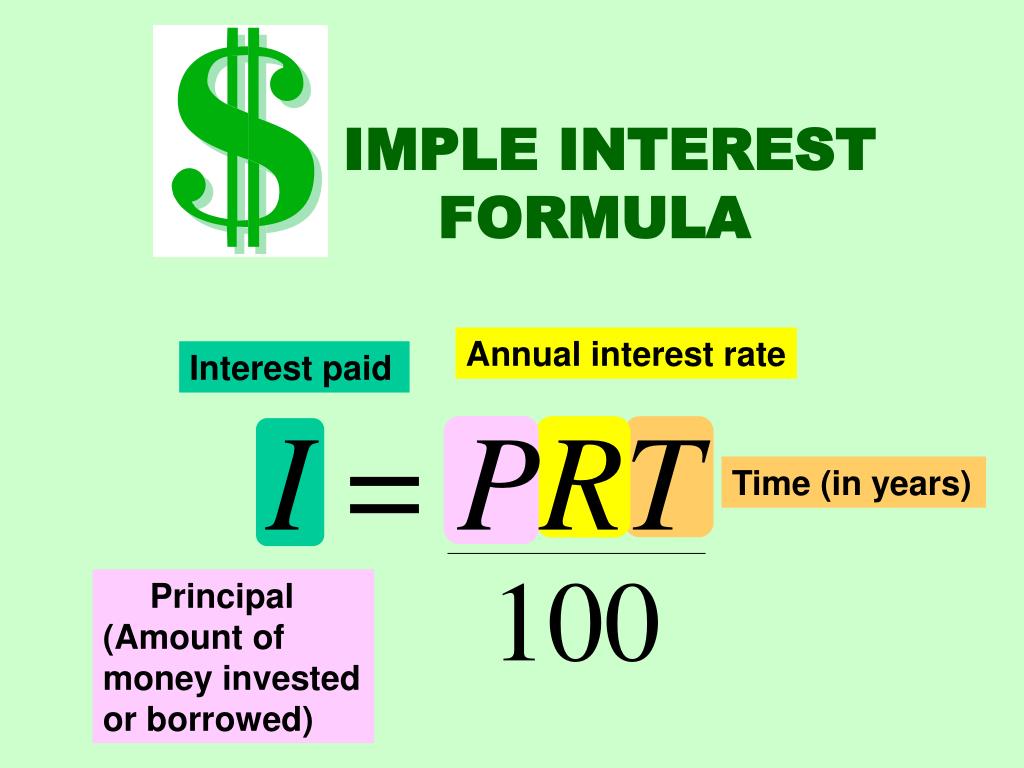

Simple Interest Formula

- If you want to know how much simple interest you’ll pay on a loan over a given time frame, simply sum those payments to arrive at your cumulative interest.

- Simple interest only pays interest on the principal balance, while compound interest also pays interest on the interest that is earned.

- On the other hand, compound interest is what you get when you reinvest your earnings, which then also earn interest.

- The U.S. government and private businesses borrow money from the general public in the form of bonds they issue and pay interest on.

- We will break the formulas down step by step, but the easiest way to do them is to use a calculator.

The original amount of money borrowed or loaned is called the ‘principal’. The major difference between simple interest and compound interest is that simple interest is based on the principal amount. In contrast, compound interest is based on the principal amount and the interest compounded for a cycle of the period. Notice how the interest payments shrink as the principal of the loan goes down.

Simple interest is an investment where the interest you earn does not change throughout the term of the investment. This is because there are no added funds to your initial investment during the term of an investment, so how much money your initial investment earns stays constant. In our example of a 3-year investment, there would be 12 interest periods if interest were compounded quarterly. Therefore, through compounding, interest is earned or incurred not only on the principal but also on the interest left on deposit. To see why not over-rounding is so important, suppose you were investing $1000 at 5% interest compounded monthly for 30 years.

After the first year, you receive a $50 interest payment, but instead of receiving it in cash, you reinvest the interest you earned at the same 5% rate. For the second year, your interest would be calculated on a $1,050 investment, which comes to $52.50. If you reinvest that, your third-year interest would be calculated on a $1,102.50 balance. A. When the interest is charged on the initial amount that is lent to the borrower, it is called simple interest. Whereas when the interest is calculated on the initial amount and the interest accumulated over a period of time is called as compound interest.

Your initial investment (PV) of $10,000 is shown with a negative sign according to the cash flow convention because it represents an outflow of funds. PV and FV must necessarily have opposite signs to solve “i” in the above equation.