Refinancing Money

Refinancing finance are a great way so you’re able to consolidate personal debt and save cash on interest. Refinancing occurs when you replace the regards to your existing mortgage and take aside another mortgage to pay off a vintage one to. When you re-finance, you can choose from numerous alternatives and lower desire prices, lengthened cost attacks, and/otherwise all the way down monthly installments. When you yourself have a less than perfect credit record, refinancing makes it possible to beat the your debt and possess back on the right track with your finances.

You are entitled to an emergency financing when you yourself have become underemployed for only a short while and possess income arriving off their supplies, like a pension or Public Coverage positives. you should have good credit, a dynamic checking account, and the power to pay-off the mortgage on time.

If you’d like currency rapidly, an urgent situation loan would-be their provider. It’s not suitable for individuals, regardless of if. So before you apply for example, check out this type of eligibility requirements.

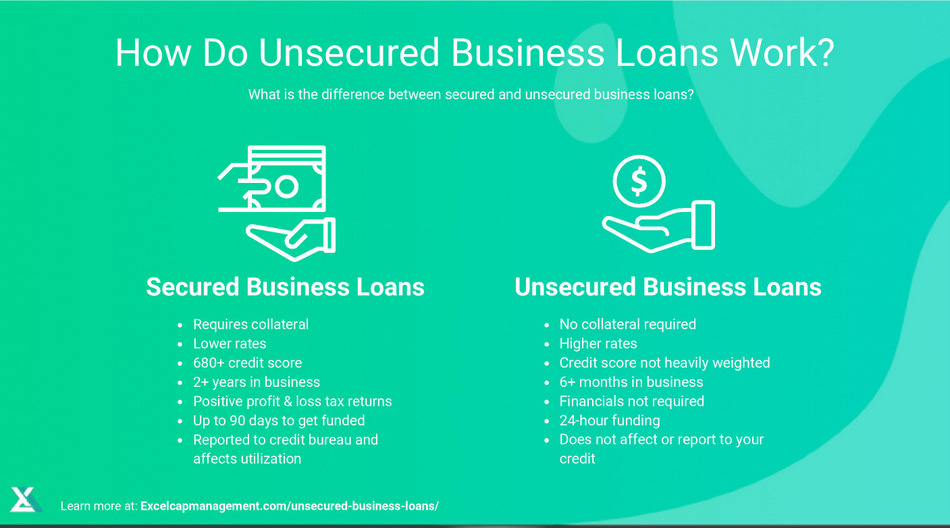

Difference between Protected and you will Unsecured loans

It’s not hard to get confused about the difference between guaranteed and signature loans, particularly when you’re looking for that loan to support their costs. You think you to definitely an ensured mortgage is similar material as the that loan with no collateral, but they’ve been in reality very different. Here’s what you should know:

Guaranteed Fund

A guaranteed loan is just one that’s supported by a friends otherwise company, if you find yourself that loan without security actually backed by things browse around this web-site almost every other than your credit rating. Guaranteed funds are typically provided by banking institutions otherwise insurance vendors, when you find yourself personal loans are offered of the non-lender lenders such borrowing from the bank unions otherwise fellow-to-peer credit web sites. A timeless unsecured loan needs a down payment or collateral.

Personal loans

Personal loans are given with no equity otherwise advantage kept of the the lender once the coverage to have payment of your financing. With a consumer loan, you really must have a good credit rating or assets such as for instance assets otherwise stocks which are available in circumstances your falter and also make repayments on the mortgage. If you do not satisfy this type of requirements, it can be difficult to get a personal bank loan. On the other hand, personal loans always bring higher rates than just secured finance due to the fact it hold significantly more exposure getting lenders.

The dangers regarding Crisis Fund

Disaster finance was a variety of brief-term financing, always which have a very high-interest. They are often accustomed coverage unforeseen expenditures such as scientific bills, automobile fixes, and other things that can not be postponed. Once the emergency financing manufactured as the quick-identity loans rather than enough time-identity resource, they tend to not have of several possess who help you manage your loans eventually.

The issue is that these crisis funds are created to feel removed when you really need him or her most. And if you are taking away an urgent situation loan because you never have enough money readily available, it’s likely that discover yourself credit once more when various other crisis appears. This will become a vicious cycle in which you remain which have to carry out the new finance only in order to pay-off those of past day. Plus, you ought to avoid agent fund. Usually, brokers features large interest rates and don’t offer borrowing from the bank conclusion.

Faq’s

There are a great number of individuals who you would like loans while they’re underemployed-they just do not learn where to go otherwise how to handle it. That’s why we now have assembled so it range of frequently asked questions on funds having out of work some one. Hopefully it will help reply to your issues and you can part you into the the right guidance!